If you make only the monthly payments set by your mortgage company, in the end, you will pay a significant amount of interest. Making biweekly mortgage payments can save you money by reducing interest and shortening the term of the loan. Here’s how.

Chipping away a little at a time

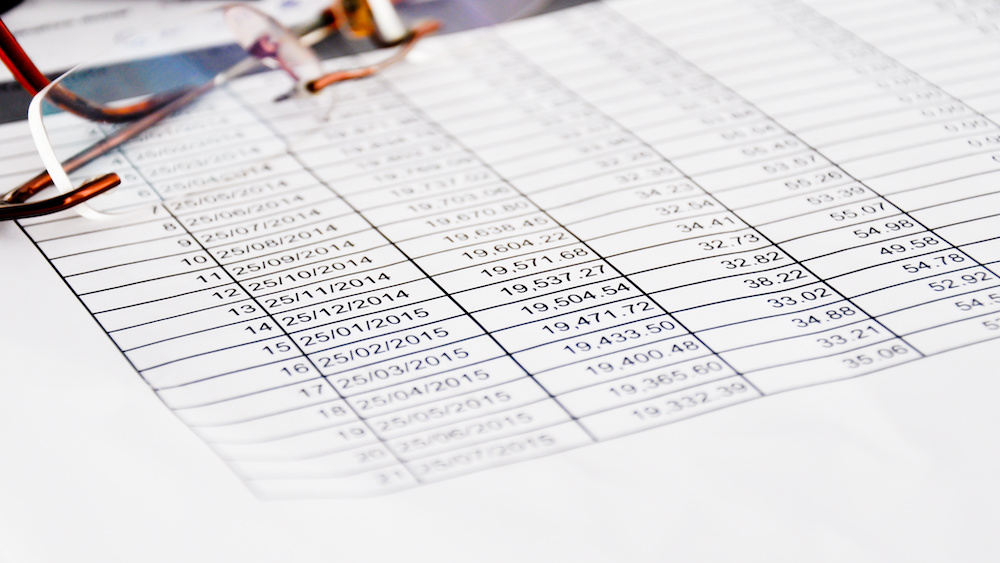

Paying off a mortgage over 30 years and according to the established payment schedule costs you lots of interest.

With biweekly mortgage payments, you split your monthly payment, sending half every two weeks. Over the 52 weeks in a year, you’ll make 26 payments, or the equivalent of one extra month’s payment each year. Over time, paying biweekly can save you tens of thousands of dollars in interest and shorten the life of the loan by several years.

As an example, paying biweekly on a 30-year, $250,000 loan at 4 percent interest will shorten the loan by five years and save about $30,000 in interest.

Is this option available to you?

Many mortgage companies allow you to sign up for biweekly payments. If yours does not, inquire if there is a way for you to make biweekly payments on your own.

If not, there is another way to accomplish the same effect. Log into your online account and look for an amortization schedule for every year of your loan. For a given year, add up the principal portion of each monthly payment to get the total principal scheduled to be paid that year. Divide that amount by twelve and add that figure to each monthly payment. Be sure to designate on each month’s payment that the extra amount is to be applied to principal. If you have room in your monthly budget to do this, you’ll save even more interest and pay off the loan even more quickly than you would by making biweekly payments.

Watch out for third-party payment firms

Third-party payment processing services offer to accept your bimonthly payments and make them to the mortgage company for you. Though this sounds great, the services generally charge a set-up fee as well as a monthly fee. There is no reason to pay fees to a company to do what you can accomplish on your own. You are also still personally responsible for your payment if the third party doesn’t pay in time.

When biweekly payments don’t make sense

If you don’t plan to live in your home for many years, making biweekly or extra principal payments may not make financial sense. Do the math and compare: Are homes in your area appreciating at a higher rate than you could make if you invested the money you’d use for the extra payment elsewhere?

If you need that extra payment amount to save for other things such as future college costs or retirement, invest in those instead.

Finally, if your mortgage originated in the recent era of historically low-interest rates, it may make more sense to accelerate payment on other, higher interest loans you may have.

Related – An Inside Look at Your Monthly Mortgage Payment