It’s true. Mortgage rates had risen slightly over the past several months, but is that reason enough to halt your search for a new home? Not likely, because mortgage rates have since dropped and are still at historic lows.

It’s a Numbers Game

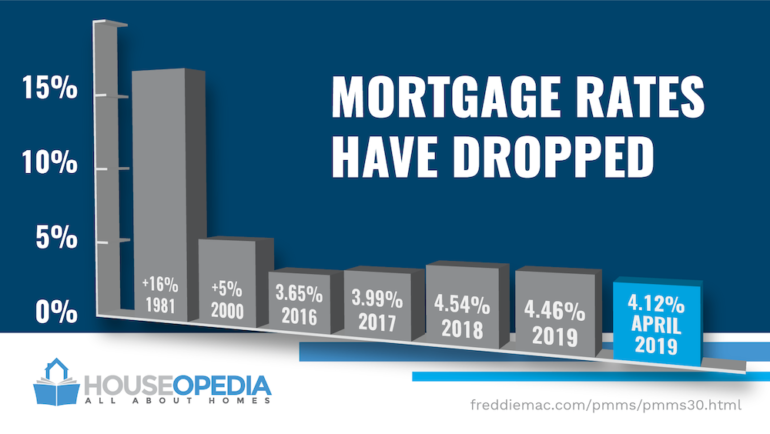

Simply put, the lower your rate, the lower your house payment. Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac) outlines the history of rates and how they have trended. According to Freddie Mac data, the annual average for 2016 was 3.65 percent and crept a bit higher to 3.99 percent in 2017, both slightly less than the average rate of 4.54 percent for 2018. However, current rates for the week ending April 11, 2019, have dropped to 4.12%.

That said, rates at or below the 5-percent mark remain a bargain when compared to the 1970s, 1980s, and 1990s when mortgage rates were often in the 7-to-10 percent range and spiked at more than 16 percent in 1981. Even in more recent history, rates were more than 5 percent from 2000 to 2009.

What Do Mortgage Rates Mean for the Economy?

Current mortgage interest rates indicate a strong economy with low unemployment, all positive for homebuyers. Stable employment levels mean homeowners sell their homes and then purchase new ones. While rising mortgage rates typically cause potential buyers to pause, remember that the current numbers need to be put into historical context.

Low Inventory

Buyers who purchased at a lower rate may feel the need to delay selling to avoid higher interest and housing payments. This type of thinking, however, can cause housing inventories to drop, which means more competition among buyers for fewer homes. That, of course, drives prices higher.

Should You Wait to Buy or Sell?

Everyone wants a good deal on their next home purchase. However, those who postpone a purchase may likely face higher interest rates. And remember, a boost in the housing inventory will help keep the supply/demand variable stable and housing prices less likely to increase so quickly.

Related – When to Lock In — Or Float — a Mortgage Rate