One of the most important steps in the home-shopping process is for buyers to have an initial assessment of their ability to get a mortgage. As a buyer, already having a mortgage preapproval letter from...

One of the most important steps in the home-shopping process is for buyers to have an initial assessment of their ability to get a mortgage. As a buyer, already having a mortgage preapproval letter from...

Foreclosure was likely the farthest thing from your mind the day you closed on your home. But sometimes, life circumstances intervene and leave you unable to pay your mortgage. Fortunately, there are steps you can...

Whether you are self-employed, a freelancer or have a variable income stream, you’ll face special challenges getting a typical mortgage and may need to apply for a bank statement loan. What is a bank statement...

Most consumers know about identity theft and have adopted safe practices for dealing with their personal information. But did you know thieves can steal the title to your property? Property title theft could happen right...

Homeowners face stiff penalties both for paying off their mortgages early and for making their monthly payments late. Here’s how mortgage prepayment and late payment penalties work and what you can do to avoid them....

If you’re in the market for a home, particularly your first one, it’s advisable to meet with a mortgage lender at the beginning of the process. Having a mortgage pre approval letter from a lender...

Experts stress the importance of maintaining good credit before you apply for a mortgage. But after you get that mortgage and close on a new house, what happens to your credit score? Keep working hard...

Securing a good interest rate and qualifying for a home require a good credit report. That’s easier said than done, especially for today’s millennials who are often weighed down by student loan debt. Here’s a...

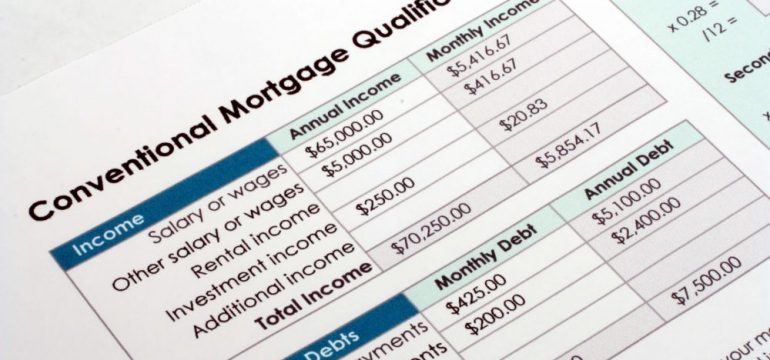

When you apply for a mortgage, your lender will have you complete the Uniform Residential Loan Application (URLA). This form, designed by the federal government and used nationwide, can be daunting for first-timers. Being informed...

Buyers generally must get a mortgage loan to buy a house. Wise buyers include a mortgage loan contingency clause in the sales contract with the seller to protect themselves should they be unable to get...