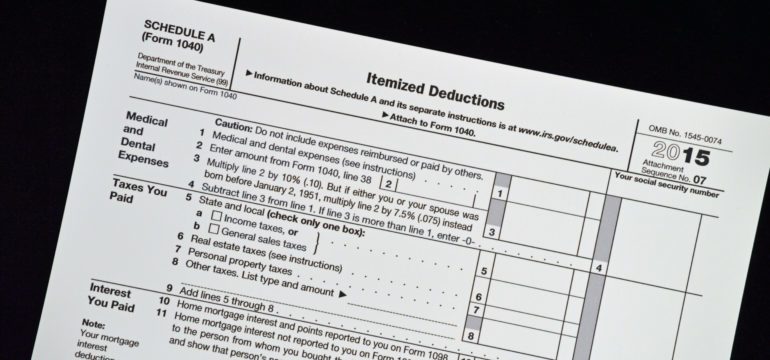

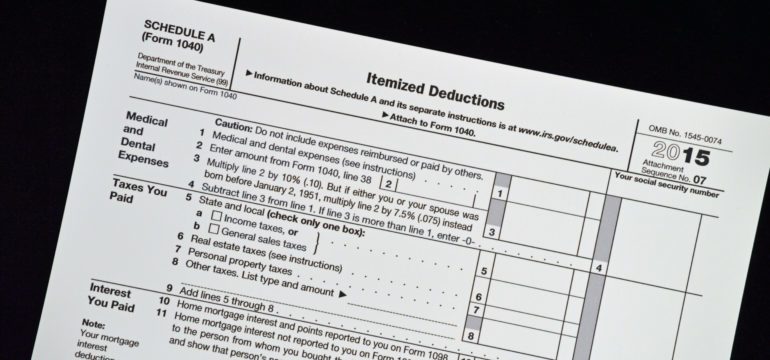

For most people, their home is their biggest investment — and their biggest tax benefits. As always, it’s best to consult your tax adviser for specific information, but let’s walk through the most common, basic...

For most people, their home is their biggest investment — and their biggest tax benefits. As always, it’s best to consult your tax adviser for specific information, but let’s walk through the most common, basic...

Do you have bad credit? While legitimate credit repair services can help improve your credit scores, you can do the work yourself and save money. Here’s how. Pull your credit report at www.annualcreditreport.com. It’s free....

It’s important to shop for the perfect place to call home, but don’t forget to shop around for the best financing, too. The quality of the terms of your mortgage can mean a difference of...

Mortgage lending is yet another industry that has undergone massive change by the internet. Online lenders advertise fast and easy transactions while traditional lenders offer more personal service. Regardless of which option you choose, it’s...

In the often-confusing world of finance, the Consumer Financial Protection Bureau (CFPB) is a valuable source of free information for homebuyers and others making a major purchase or investment. Created by Congress following the 2008...

When buying your first house, the terms and conditions of the mortgage process can be confusing. Here’s a primer on two such terms: points and the origination fee. Origination fee. This is the cost that...

Homebuyers must make two large payments when purchasing a house. One is the earnest money paid upon execution of the sales contract. The second is the down payment to the lender at closing. What are...

Shopping for a home also means shopping for a mortgage. If this is all new to you, the multitude of mortgage types might be confusing. Here’s what you need to know. Fixed-rate mortgage. The fixed-rate...

Each month you send off a hefty chunk of money to your mortgage company. If you’re like most people, it represents 25 percent to 30 percent of your income. That payment is split into as...

Buying a first home is a rite of passage. After crunching the numbers, receiving preapproval for a mortgage and finding a trustworthy agent, you’re ready to go house hunting. To make the adventure less daunting,...